Home > Mergers > Suitor Model

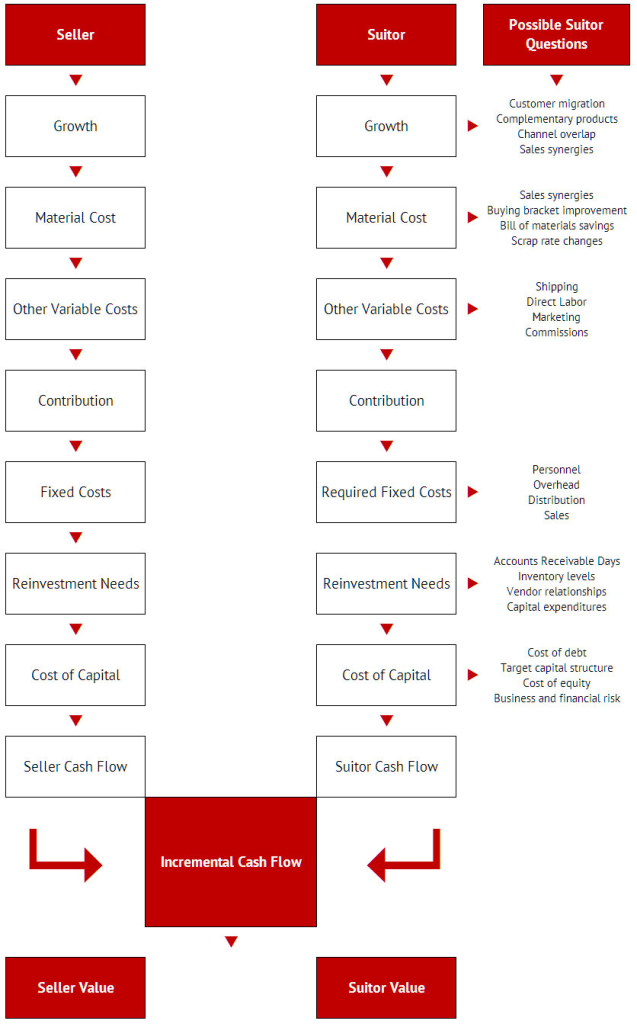

Our Suitor Model incorporates performance attributes of the seller in combination with estimates for the buyer as to the likely effects related to the transaction. These effects include estimates for revenue, migration of revenue from the seller, shifts in the material and variable cost structure, incremental fixed costs, required investment in fixed and working capital, cost of capital considerations, and taxes. For more information on Penn Hudson, please contact us.

Questions asked by our clients about our Suitor Model include:

- How should synergies arising out of the transaction be shared?

- Which performance characteristics of the company best match up with the needs or strategies of potential acquirers? Which issues, like customer concentration, need explanation?

- If the value/price gap cannot be bridged today, what route must the company follow to improve its performance and value and how long will this take?

- Can the Suitor Model work with estimate ranges for the buyer as opposed to exact numbers?

- How sensitive are certain of the estimated variables on the value of my company to the buyer?